Top AMR Companies (2025 Guide): Compare Vendors, Use Cases & ROI

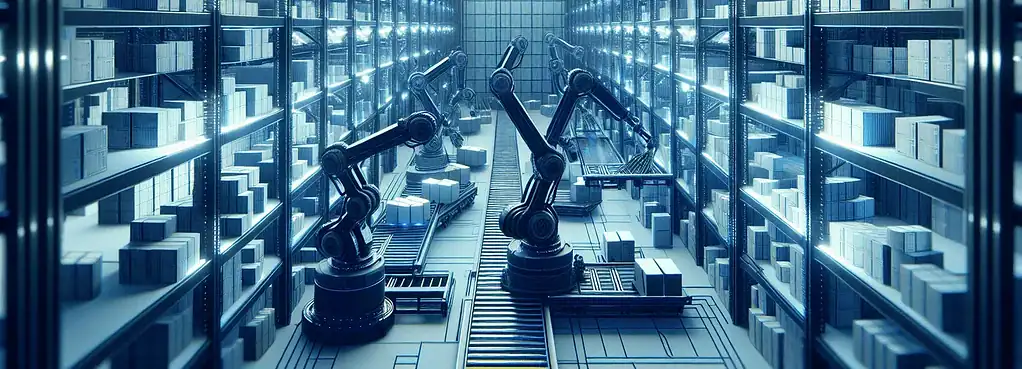

Autonomous Mobile Robots (AMRs) are now a mainstream method for boosting throughput without requiring major facility rework. The best AMR companies pair robots with software (RMS/FMS), rapid deployment, and predictable payback—often inside one peak season. This guide shows where AMRs fit, how pricing works, and what to evaluate before you sign.

AMR Basics: What They Do (and Don’t)

AMRs utilize onboard sensors/LiDAR, combined with fleet software, to move totes, shelves, pallets, or carts between workstations. They’re ideal for piece picking, replenishment, lineside delivery, zone-to-zone transport, and returns. They’re not a fit when you need high-bay storage (that’s AS/RS) or fixed high-speed sortation.

AMR Companies by Category (Shortlist Builder)

Use this to narrow your vendor list by need. (Examples are to help your research—not endorsements.)

Shelf-follow / collaborative picking: good for e-commerce, each-picking with humans walking less.

Examples to evaluate: Locus, 6RS-style solutions, Geek+ P-series.Goods-to-person (G2P) tote shuttling: robots bring totes/shelves to pack stations; high productivity with small footprint.

Examples: Geek+, GreyOrange, inVia-style systems.Tugger / cart-pulling AMRs: milk-run replenishment, lineside delivery.

Examples: MiR (Mobile Industrial Robots), OTTO Motors, Seegrid (hybrid AMR/AGV).Pallet movers/pallet jacks AMR: pallet transport without drivers; dock-to-putaway or buffer lanes.

Examples: MiR pallet movers, OTTO pallet AMRs.Specialized case/box handling or sortation-adjacent AMRs: flexible routing without fixed conveyors.

Examples: solutions from GreyOrange/Geek+ portfolios.

AMR Companies vs AGV Vendors (Quick Contrast)

Navigation: AMR = dynamic pathing with sensors; AGV = fixed paths/markers.

Flexibility: AMR reconfigures with software; AGV usually needs layout work.

Use cases: AMR excels in variable, people-dense environments; AGV is ideal for repetitive, fixed routes.

Pricing & Commercial Models (What to Expect)

CapEx purchase: robot, software, and integration; annual support is provided.

Robotics-as-a-Service (RaaS): monthly fee per robot/fleet; includes hardware, software, and support.

Hybrid: low upfront + performance-based monthly.

Rule of thumb inputs: robots required = (target UPH – baseline UPH) ÷ robot contribution per hour × peak hours. Add stations, chargers, spares, and software seats.

ROI: Simple Payback Model

Baseline: 40 pickers @ $25/hr, 250 days, 2 shifts → ~320,000 labor hours/year.

With AMRs: 20–35% productivity lift typical in each pick.

Savings: 25% × 320,000 × $25 = $2,000,000/year (before maintenance/fees).

Payback: typically 6–12 months, depending on the model and peak profile.

Evaluation Checklist (Use in Demos)

Throughput proof: live UPH/LPH on your SKU mix.

Congestion handling: what happens at choke points & crosswalks?

Battery strategy: runtime, charge time, hot-swap vs opportunity charge.

Safety layers: ISO, PLd/Cat3, pedestrian detection, speed zones.

WMS integration: tested adapters for your system + error handling.

Change control: how fast can you add zones, stations, and missions?

Service model: spare pools, on-site SLAs, remote monitoring.

Total cost: robots, software, stations, installation, training, upgrades.

Common Pitfalls (Avoid These)

Buying robots without redesigning the pick path. Fix slotting and travel first.

Under-estimating stations. Too few pack/induct stations create robot traffic jams.

KPI overload. Track 2–3 metrics: UPH, travel saved, order cycle time.

No change management. Train leads early; publish new SOPs.

Notable AMR Companies to Evaluate (2025)

A non-exhaustive set to start vendor calls (covering multiple categories):

MiR (Mobile Industrial Robots), OTTO Motors, Locus Robotics, Geek+, GreyOrange, Seegrid (AMR/AGV hybrid), inVia, Zebra’s Fetch Robotics line.

Shortlist 3–5 based on your use case, then request a paid pilot with your data and floor.

FAQs

Are AMRs safe to run around pedestrians?

Yes—multi-layer safety: LiDAR, vision, speed zones, and PLd safety circuits—plus your floor markings and training. Amazon even provides e-vests to communicate your location to this equipment.

Do AMRs replace pickers?

They remove walking, not judgment. Most sites redeploy labor to higher-value tasks and keep headcount flat during growth.

How long does deployment take?

Small pilots: 8–12 weeks. Full rollouts: 3–6 months, depending on integration and station build-outs.

What about Wi-Fi and IT?

Plan for robust 5 GHz/6 GHz coverage, VLANs, and QoS; involve IT early.

Conclusion

AMRs are a flexible, fast-payback way to scale throughput without rebuilding your DC. Start with a targeted use case, optimize slotting, pilot with real data, and measure three key metrics. The right AMR company will show results in weeks—not years.